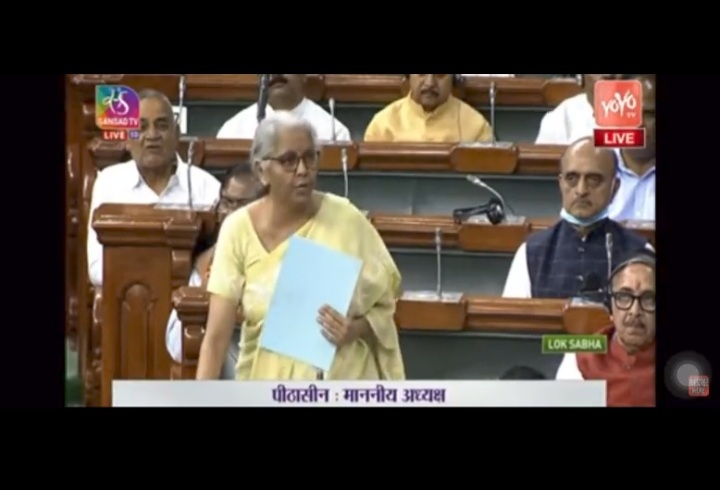

The Chartered Accountants, the Cost & Works Accountants and the Company Secretaries (Amendment) Bill,2021 passed in LokSabha

The Chartered Accountants, the Cost and Works Accountants and the Company Secretaries (Amendment) Bill, 2021 was passed by Lok Sabha on Wednesday. Download the pdf of the bill The Bill seeks to amend the existing Chartered Accountants Act (ICAI), 1949, the Cost and Works Accountants Act, 1959 and the Company Secretaries Act 1980. The Bill is aimed at providing mechanism for dealing with the cases of misconduct in the three professional institutes, namely, the ICAI, the Institute of Cost Accountants of India and the Institute of Company Secretaries of India and “with a view to strengthening the existing mechanism and ensure speedy disposal of the disciplinary cases.” The Bill seeks to propose amendments related to existing Acts related to all three Institutes but not related to any Implementation of New Bill Related to IIA. The changes made in the Bill is no way related to Implementation of New Act IIA Act but Amendments related to disciplinary proceedings of Institutes. Ev